Go big or stay home; or in this case, go big and lose your home

/40 howard road

I’ve always wondered at the stupidity of bank robbers, whose average take is, according to the FBI, around $3,500, while the average sentence upon conviction is 7.5 years; for anyone who values his time, and admittedly, many of these de-depositors probably don’t, that’s a terrible risk/reward ratio.

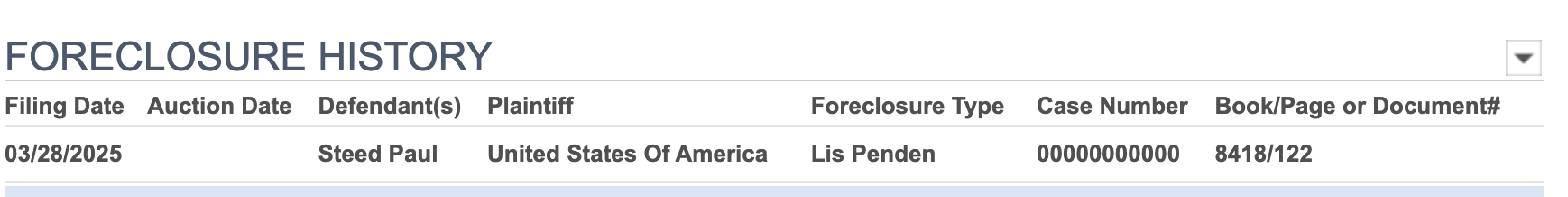

So it was with a certain admiration that I read in Greenwich Free Press about the exploits of a Mr. Paul R. Steed, who took the time and effort to at least make the game worth the candle; or it would have been, had he not been caught. He had a nice run, though, and even managed to purchase a modest home in Greenwich at 40 Howard Road in 2023*. That house will apparently be returning to the market soon; Mr. Steed’s own personal resurfacing may be more protracted.

Stamford Man Pleads Guilty to Fraud and Tax Charges Related to Theft of More Than $28 Million from Mars, Inc.

David X. Sullivan, United States Attorney for the District of Connecticut, announced on Thursday that Paul R. Steed, 58, of Stamford, pleaded guilty earlier in the day in Bridgeport to fraud and tax offenses stemming from his commission of multiple frauds against his former employer Mars, Inc.

According to court documents and statements made in court, between approximately 2011 and 2023, Steed was employed by Mars Wrigley, a subsidiary of Mars. Inc. (“Mars”), working remotely from his home in Stamford.

Steed served in several positions at the company and last served as Global Price Risk Manager for Mars Wrigley’s Global Cocoa Enterprise. As part of his employment, Steed was responsible for managing Mars Wrigley’s participation in the U.S. Department of Agriculture (“USDA”) Sugar-Containing Products Re-Export Program.

In approximately 2016, Steed created a company, MCNA LLC, to mimic an actual Mars entity, Mars Chocolate North America. He then diverted more than $15 million in Mars assets to a bank account he set up in MCNA’s name by directing sugar refineries purchasing Mars’s re-export credits, obtained through the USDA program, to pay MCNA LLC as if it were a legitimate Mars entity.

Mars had an ownership interest in Intercontinental Exchange, Inc. (“ICE”), a financial services company that operated financial exchanges and clearing houses, and received quarterly dividends in connection with that ownership. In 2017, Steed directed Computershare Limited (“Computershare”), a company that ICE utilized for stock-related services, to pay MCNA LLC for Mars’s dividends from its ownership shares in ICE. As a result, more than $700,000 in dividend payments were diverted to the MCNA LLC account. In 2023, after Steed had used a fraudulent letter purportedly from the Mars Treasurer authorizing him to trade ICE shares, Steed directed Computershare to sell Mars’s ICE shares entirely. Computershare issued a check in the amount of more than $11.3 million, which Steed deposited into the MCNA LLC account.

In addition, from 2013 through 2020, Steed used a company he owned called Ibera LLC to invoice Mars for services Mars did not receive. Mars paid Ibera LLC more than $700,000 through this scheme.

Steed failed to report and pay taxes on his stolen income on his 2014 through 2023 federal tax returns.

Steed pleaded guilty to two counts of wire fraud, an offense that carries a maximum term of imprisonment of 20 years on each count, and one count of tax evasion, an offense that carries a maximum term of imprisonment of five years.

Steed has agreed to pay restitution of $28,410,489 to Mars, Inc., and the government has calculated that he owes the IRS an additional $10,310,680 in back taxes.

The government has seized, and Steed has agreed to forfeit, more than $18 million from bank accounts controlled by Steed, and the government is seeking to forfeit, or alternatively liquidate for restitution, a Greenwich home that Steed is alleged to have purchased with nearly $2.3 million in stolen funds. It is alleged that another $2 million was sent by Steed to Argentina, where he is a dual citizen, has family ties, and owns a ranch.

Steed was arrested on March 26, 2025. He is released on a $5 million bond pending sentencing, which is scheduled for December 9.

*In a bidding war, no less, paying $2.525 million on a list price of $2.3; ah, the power of OPM: Other People’s Money